2024 Traditional Ira Contribution Limits. For 2024, the ira contribution limit is $7,000. Highlights of changes for 2024.

The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. The roth and traditional ira contribution limits are $6,000 in 2021 if you’re under age 50.

The Maximum Contribution Limit For Roth And Traditional Iras For 2024 Is:

Yes — in 2024, the ira contribution limit for roth and traditional plans increases to $7,000 or $8,000 for contributors 50 or older.

$7,000 In 2024 And $8,000 For Those Age.

Contribution limits increase for tax year 2024 for traditional iras, roth iras, hsas, sep iras, and solo 401 (k)s.

$7,000 If You're Younger Than Age 50.

Images References :

Source: angilqmodesta.pages.dev

Source: angilqmodesta.pages.dev

Ira Limits For 2024 Abbey, $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50. Irs unveils increased 2024 ira contribution limits, contribution deadline for sep iras employer contributions to a sep.

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2023 and 2024 Skloff Financial, For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older. $8,000 if you're age 50 or older.

Source: blockbitbank.com

Source: blockbitbank.com

IRA Contribution Limits And Limits For 2023 And 2024 BlockBitBank, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. Following are the limits for 2023 and 2024.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, Yes — in 2024, the ira contribution limit for roth and traditional plans increases to $7,000 or $8,000 for contributors 50 or older. For the 2023 tax year, the irs set the annual.

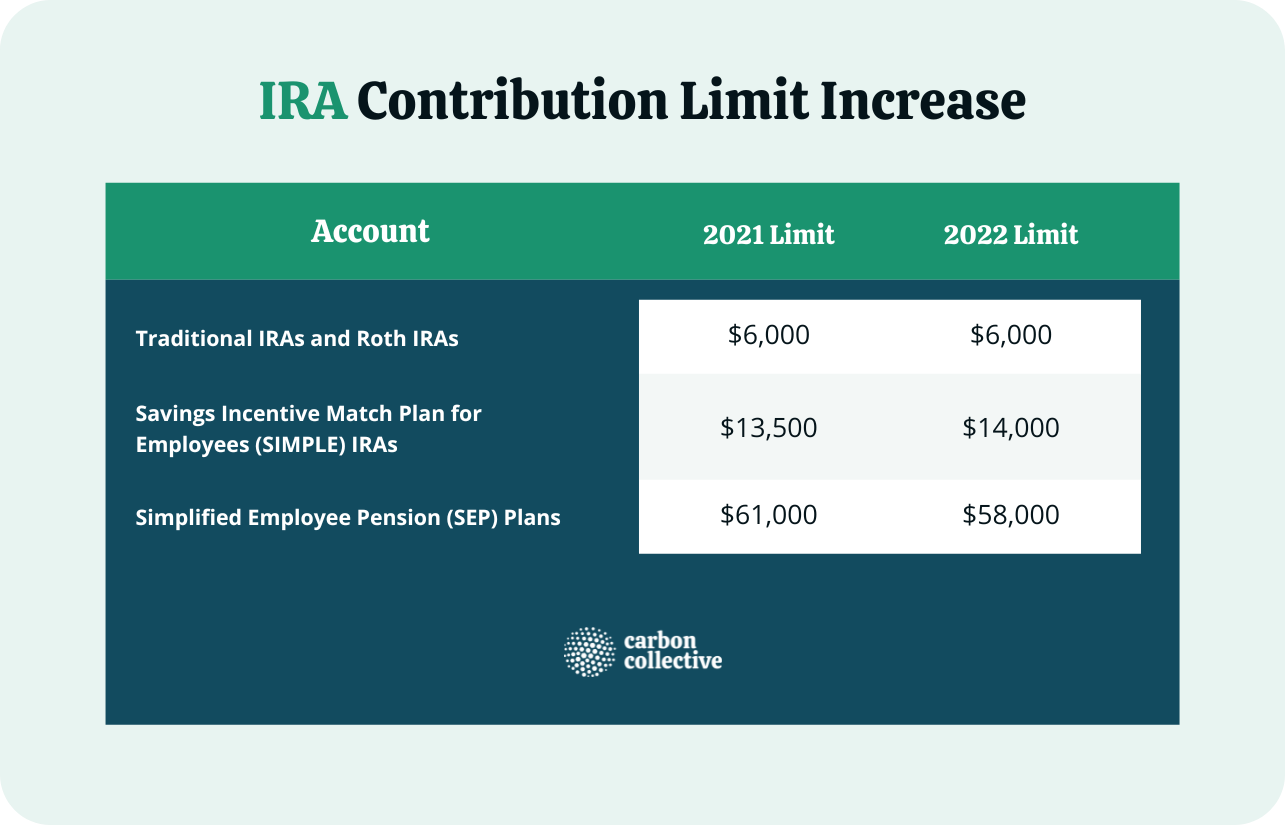

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, The 2024 traditional ira limit is $7,000 if you’re 49 and under and $8,000 if you’re 50 and over. Fact checked by kirsten rohrs schmitt.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, The roth and traditional ira contribution limits are $6,000 in 2021 if you’re under age 50. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, Following are the limits for 2023 and 2024. 401 (k), 403 (b), 457 (b), and their roth equivalents.

Source: choosegoldira.com

Source: choosegoldira.com

simple ira contribution limits 2022 Choosing Your Gold IRA, Ira contribution limits for 2024: The maximum contribution for the 2024 tax year is $7,000 a year.

Source: themilitarywallet.com

Source: themilitarywallet.com

2024 Traditional and Roth IRA and Contribution Limits, Contribution limits increase for tax year 2024 for traditional iras, roth iras, hsas, sep iras, and solo 401 (k)s. For 2024, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older.

Source: fancyaccountant.com

Source: fancyaccountant.com

What is a Roth IRA? The Fancy Accountant, The roth and traditional ira contribution limits are $6,000 in 2021 if you’re under age 50. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

The 2024 Annual Ira Contribution Limit Is $7,000 For Individuals Under 50, Or $8,000 For 50 Or Older.

For 2024, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older.

The Total Combined Limit For Contributing To An Ira (Including Traditional And Roth) Is:

Irs unveils increased 2024 ira contribution limits, contribution deadline for sep iras employer contributions to a sep.